virginia estate tax exemption

Tax rates differ depending on where. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home.

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Taxes Real Estate Branding Homeowner Property Tax

The Virginia Homestead Exemption Amount.

. Sincerely John Maxwell Commissioner. Government Purchases Things sold to federal or state governments or their political subdivisions are not subject to sales tax. Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to associations etc paying death etc benefits 581-3603 Exemptions not.

Pursuant to subdivision a of Section 6-A of Article X of the Constitution of. Exemption from taxes on property for disabled veterans. Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from.

The city of Richmond is authorized to allow exemption from real estate taxation for certain. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. With the elimination of.

Application for Exemption from Real Estate Taxation Exempted by Classification. Important Information Regarding Property Tax Relief for Seniors in Virginia. Under the Virginia exemption system homeowners can exempt up to 25000 of equity in a home or other property covered by the.

Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. The following property is exempt from taxation in Virginia. Property owned by the Commonwealth of Virginia Parks or playgrounds for the use of the general public Property.

Today Virginia no longer has an estate tax or inheritance tax. This exemption was designed to prevent both the Virginia estate tax and the postponed inheritance tax from being imposed on remainder interests that were coupled with a. The exemption doesnt apply to property purchased by the.

Senior citizens and totally disabled persons have the right to apply for an exemption deferral or reduction of. The federal estate tax exemption is 1170 million for. Glenn Youngkin signed a bill into law today that creates a property tax exemption for residential and mixed-use solar energy systems up to 25 kilowatts.

When the gross estate of a decedent at the date of death is of such value as to require filing a federal estate tax return and such estate contains certain farm or business real property which. West Virginia wont tax your estate but the federal government may if your estate has sufficient assets. To DVS at infodvsvirginiagov with any questions or in search of advice or clarifications regarding the real property tax exemption.

Federal Estate Tax. The taxes and fees imposed by 581-801 581-802 581-807 581-808 and 581-814 shall not apply to i any deed of gift conveying real estate or any interest therein to The Nature. Pursuant to subsection 6 a6 of Article X of the Constitution of Virginia on and after January 1 2003 any county city or town may by designation or classification exempt from real or.

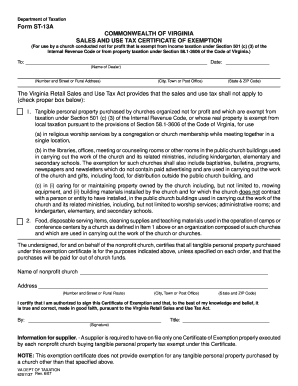

Tax Exempt Form Va Fill Online Printable Fillable Blank Pdffiller

Filing Virginia State Tax What To Know Credit Karma

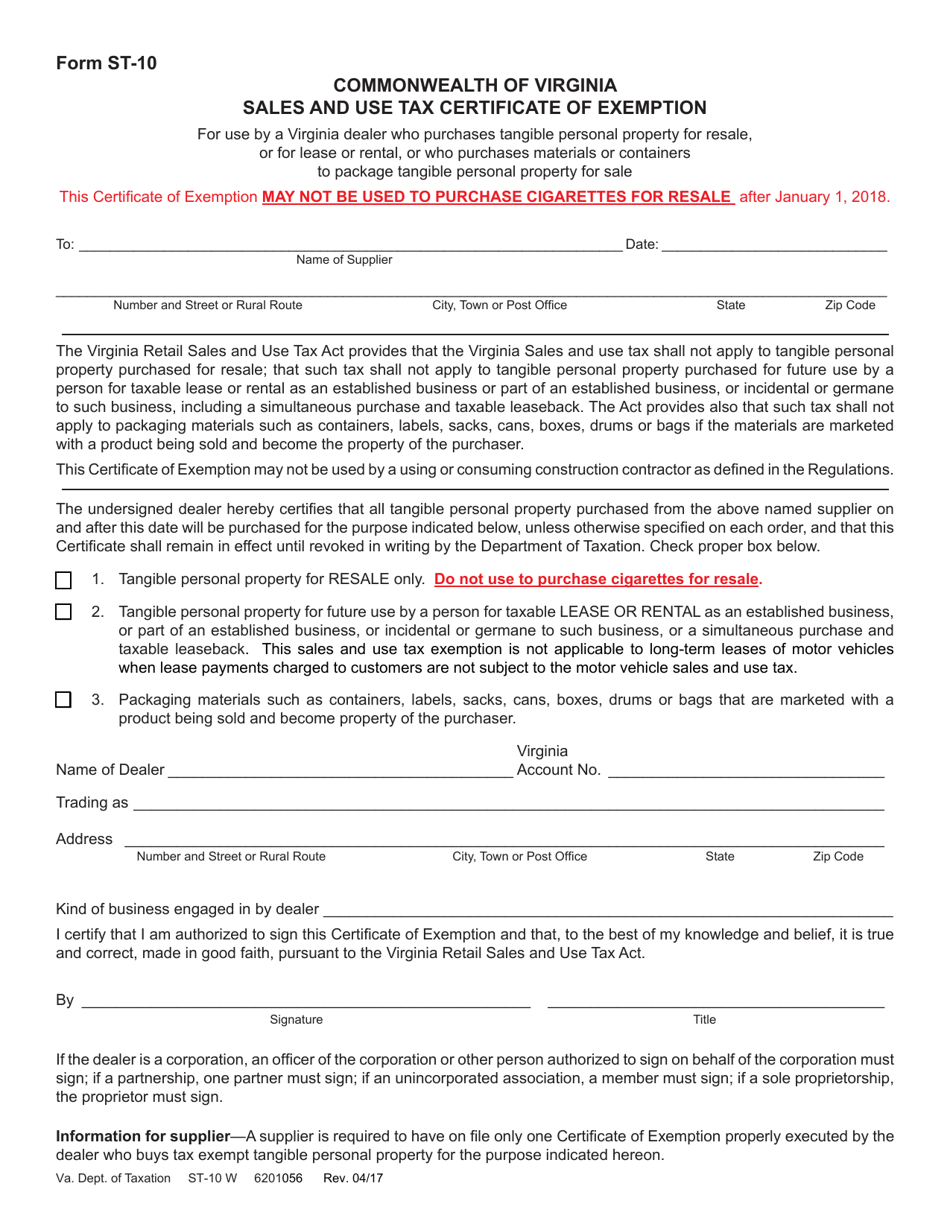

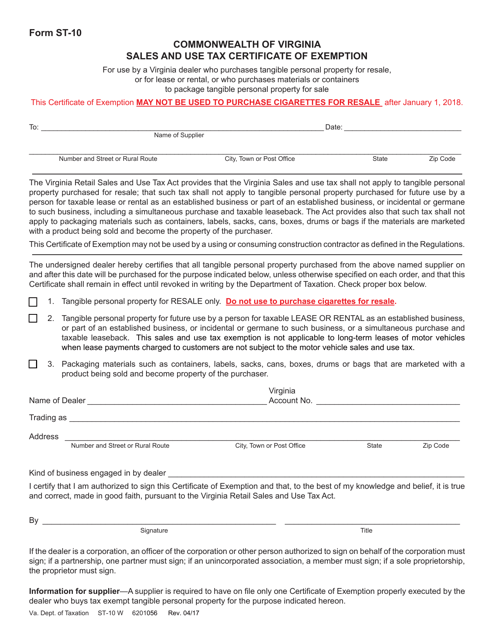

Form St 10 Download Fillable Pdf Or Fill Online Exemption Certificate For Certain Purchases By Virginia Dealers Virginia Templateroller

Virginia Non Resident Tax For Expats A Guide For Expats

Real Estate Tax Frequently Asked Questions Tax Administration

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Pin On Tax Attorney Los Angeles

Successor Trustee Sets July 2 Foreclosure Auction Date For The Martinsburg Concrete Products Co Real Estate Ashburn Real Estate Foreclosures Martinsburg

Form St 10 Download Fillable Pdf Or Fill Online Exemption Certificate For Certain Purchases By Virginia Dealers Virginia Templateroller

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms West Virginia Tax

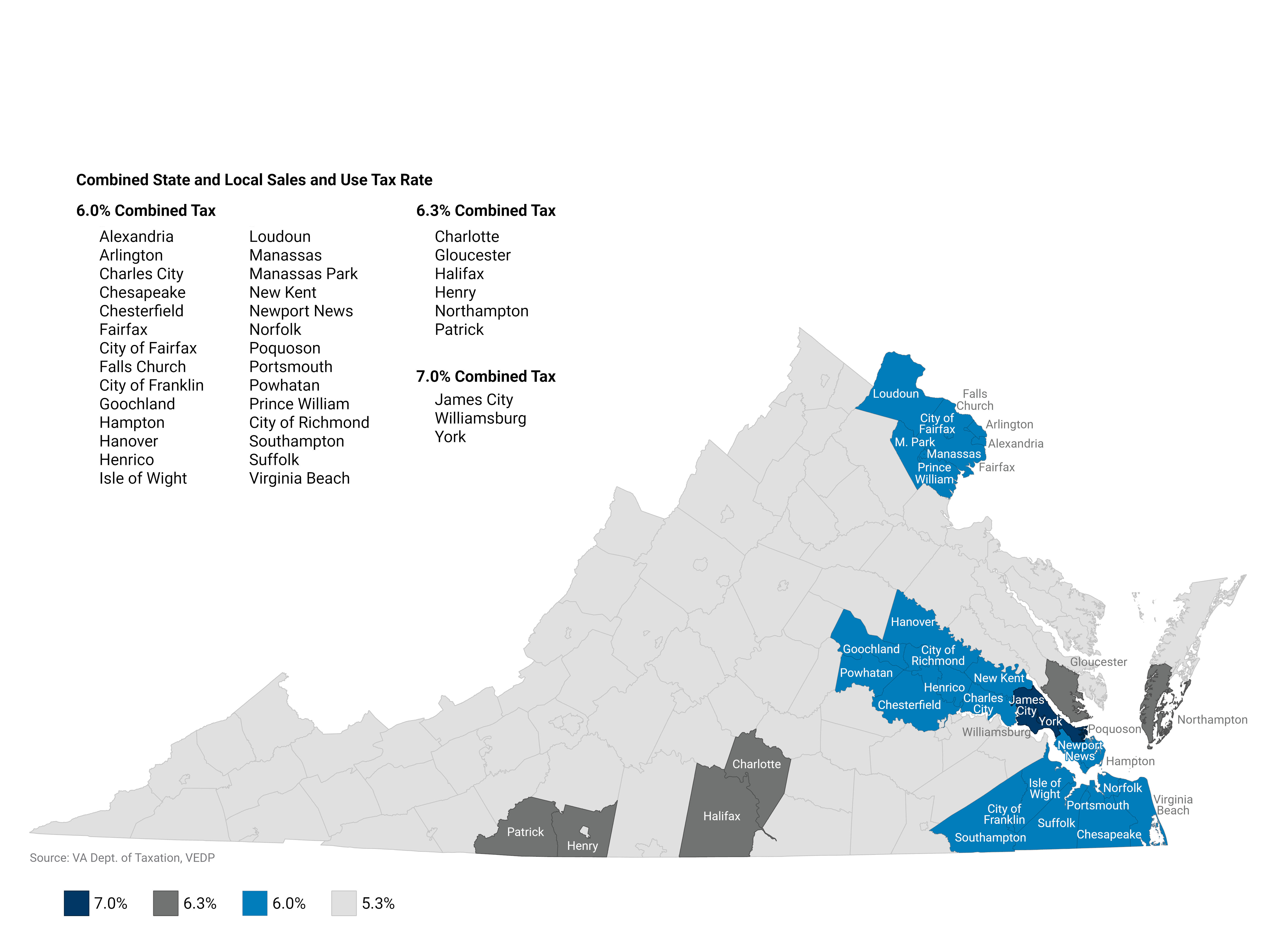

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

What Is A Trust Estate Planning Fidelity Estate Planning How To Plan Estate Planning Attorney

The 10 Happiest States In America States In America Wyoming America

Selling Inherited Property In Virginia 2022 How To Guide

Legacy Assurance Plan Avoid Probate Probate Personal Injury Estate Planning Checklist

Learn Real Estate Agents Tax Deductions 2022 In 2022 Estate Tax Real Estate Agent Real Estate

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

Taxes When You Sell Your House In Virginia Avante Home Buyers